It doesn’t seem like there should even be a Google ads vs. Microsoft (formerly Bing) Ads debate. Google processes almost 10 times more searches than Bing does. That’s billions more opportunities for marketers to get their ad in front of a customer every single day.

Yet, in 2022, marketers still spent $11.59 billion on Microsoft Ads (a 67% increase from the previous year). That growth and diversity can explain why some advertisers divert a portion of their search ad budget to Microsoft Ads. The important question is whether that might be right for you?

We dove into three pots of information to answer these questions. First, we compared the features of both advertising platforms to see what, if anything, was different. Then we compiled macro performance data that’s been reported for both Google Ads and Microsoft Ads. Finally, we dug into our own analytics— we’ve spent money advertising on Google and Bing—to see how our results compared.

A note about terminology: We originally did our research exclusively on Bing Ads vs Google Ads. Microsoft has since pulled Bing under the wider Microsoft Ads umbrella. We will refer to the general platform as Microsoft Ads, but in some cases our ads ran only on Bing as opposed to other parts of the Microsoft universe.

We will present more details ahead, but here are our top five takeaways:

- Google delivers the best click-through rates (CTR), but the Action Extensions in the Microsoft network might close the gap.

- If your goal is phone calls, Google’s your best ad play.

- Trying to reach older searchers who use desktops? Microsoft Ads has some great features for you.

- Microsoft Ads will bring cheaper traffic, but Google offers cheaper conversions.

- Microsoft Ads is very business-to-business (B2B) marketer-friendly.

We’ll show you how we came to these conclusions, plus let you know when Google ads vs. Microsoft Ads (Bing), or vice versa, would most likely net the best payback for your ad dollars.

How we did our ad data dive

For this review, we pulled 10 months’ worth of data (from January-October 2020) from our Microsoft Bing and Google Ad analytics accounts.

These were live, dynamic ad campaigns designed to deliver results, not for an experiment. So, while there may be some discrepancies between the two data sets—like slightly different optimization targets in some ad groups—we did our best to compare apples to apples.

Since we only bid for branded terms on Bing, we only pulled data for our branded terms on Google. Our ad spend breakdown for the same branded terms looked like this:

- $164K for Google ads

- $11.6K for Microsoft Bing Ads

In a perfect experiment, we would have split the spend more evenly. But in the real world, this is how most brands would have split their budgets; few will spend the same in Microsoft Ads as in Google.

Our ads appeared on both desktop and mobile, and the ads were nearly identical. Microsoft and Google seem to be in a race for parity. When one offers a new feature, the other isn’t far behind.

Finally, it’s important to note that we’re a B2B, software-as-a-service (SaaS) company. Businesses with other models and audiences will have different results from both Microsoft Ads vs. Google Ads. For example, a direct-to-consumer (D2C) cosmetics brand probably won’t care as much about targeting customers by their LinkedIn profile. But a B2B services company sure will.

For each of the takeaways we noted below, we also suggested which types of businesses would most likely benefit in each scenario.

Takeaway #1: Google wins the CTR battle

We found a 30% higher CTR from our Google ads compared to Bing. That matches the norm for most businesses. Although Microsoft Ads now offers a CTR-boosting feature that could bring parity to those results.

Overall, Google beats Microsoft in average CTR:

- Google search network CTR for all industries = 3.17%

- Bing’s CTR for all industries = 2.83%

That .34% differential doesn’t seem big. But if 100,000 people view your ad, that’s 340 additional website visitors. That delta is much greater in two categories: auto and travel/tourism. So, if you work in those industries, you could see a 50% increase in CTR on Google. It’s possible those consumer-focused industries fair well with Google’s broader demographic of searchers (you’ll see in our final takeaway that B2B ads fair well on Microsoft Ads).

Since we only compared branded search ads, our CTRs were much higher; people searching for SpyFu are willing to click a SpyFu ad. But the differential between Google and Microsoft is what’s important here. And we experienced the same Google benefit that advertisers in general saw.

- SpyFu’s Google CTR: 15.58%

- SpyFu’s Bing CTR: 10.34%

Bing’s CTR-boosting feature

Microsoft Ads offers a CTA-boosting feature called the Action ad extension.

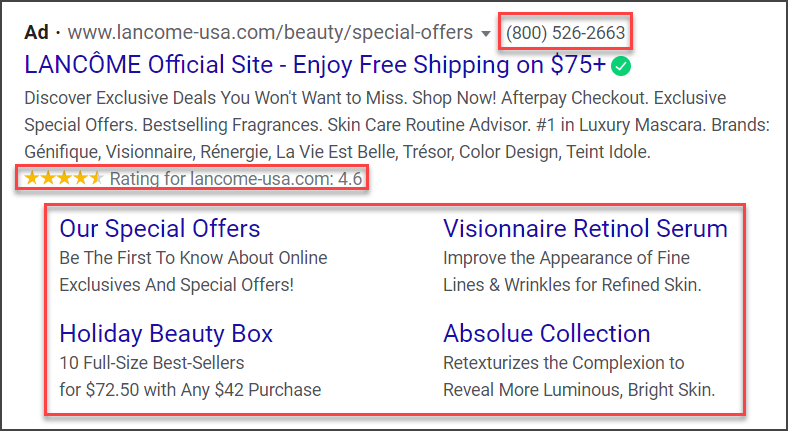

Ad extensions are the additional bits of information and links that accompany your ad headline and copy. There are many types of ad extensions, such as callouts like “free delivery,” links to specific pages of your website, and even images. This ad for Lancôme has multiple ad extensions.

For the most part, Microsoft Ads and Google Ads offer similar ad extension options. Microsoft Ads’ Action extension is a notable exception that could lift your Bing CTRs in-line with Google ad click rates.

An Action extension is a call-to-action button prominently placed on a search ad.

Here’s how a “browse” action extension looks on desktop.

And here’s a “reserve” extension on mobile.

Only Microsoft Ads, not Google, offers this type or extension, and they say it boosted CTRs in beta testing by 20%.

The bottom line

The net conclusion here is that if you’re focused on driving traffic to your website efficiently, then Google ads are a good, safe bet right now. That’s true for all industries, but if you’re in auto or travel, Google is definitely your platform. A caveat, though, is that testing Microsoft Ads using their Action extension is worth a shot if things are getting stagnant for you on Google. You may be able to achieve similar CTRs while addressing a new group of searchers.

Takeaway #2: Google is better for ads that drive phone calls

Only Google’s ad platform offers built-in “call ads” and call tracking, making it easy for marketers whose goal is to increase phone calls. Microsoft Ads doesn’t offer these functions natively. You’d need a third-party product to do the same job on Bing.

Call ads

Call ads are search page ads that lead with a phone number and a call to action.

Call ads differ from call extensions. Call extensions place a link to your phone number at the bottom of your ad.

Call ads are optimized in a couple of ways. First, you can set them to only show during the times you’re available to take calls. Second, they only show a clickable link on devices that can make calls.

These call-focused ads can make a difference. In this experiment, call ads delivered a cost per conversions (CPA) as low as $30.79. That’s roughly 37% lower than the average Google ad CPA of $48.96.

Call tracking

Along with call-only ads, Google also offers built-in call tracking. This allows you to track qualified calls as a conversion in your analytics report.

To qualify as a conversion, a person either has to click the call link in your ad or use the Google Forwarding Number assigned to the ad to call you later, then stay on the phone for a predetermined amount of time.

For example, let’s say you’ve set the qualified call duration to 30 seconds. Someone sees your ad, either clicks the call link or writes the number down, and calls you later, then chats for two minutes. That would be a conversion.

At SpyFu, we don’t rely heavily on phone calls, but we did still track them. The results show up on our Google Ads dashboard.

The bottom line

Businesses considering Google Ads vs. Microsoft Ads that rely on phone traffic would do well with Google’s call ads. In particular, local businesses that often take appointments or reservations could use this feature. Doctors’ and lawyers’ offices or restaurants are natural examples.

Takeaway #3: Bing wins with an older demographic using desktops

Bing searchers skew older compared to the average internet user, and most of them use their desktop to search.

Bing is popular with searchers 45 and up

In the U.S., nearly half of Bing searchers (46%) are over the age of 45. It’s difficult to compare this to Google’s users since they don’t report age demographics. But only 31% of total internet users are over 45, so it’s safe to say that Bing’s audience skews older than average.

Our ad results reflected this trend. For example, our Bing ad conversion rate (CR) spikes for Gen Xers.

- SpyFu Bing ad CR, 35 to 44-year-olds: 1.35%

- SpyFu Bing ad CR, 45 to 54-year-olds: 2.87%

Our CPA also dropped by half at those same age range breaks.

We don’t, however, see the same drastic shifts in performance from our Google ads. In fact, the CR of our Google ads only varies by a few tenths of a percentage point across all age groups from 25 through 65.

Bing is big on desktop

Worldwide, 9.18% of desktop searchers used Bing or Yahoo (Yahoo and AOL are part of Microsoft Ads' search network). In comparison, only about 1.1% of mobile searchers used Bing or Yahoo.

Microsoft also claims that their search network audience spends 21% more when shopping from desktop compared to the average of all searchers.

Our CTRs corroborated Microsoft's strength in desktop search.

For context, as a B2B tech company, we expect higher CTRs from desktop than from mobile. People often search for work solutions while they’re at work.

What we weren’t prepared for was how much bigger the desktop vs. mobile delta would be in Microsoft Ads vs. Google Ads.

SpyFu Google CTR by device:

- Desktop: 15.86%

- Mobile: 13.95%

SpyFu Bing CTR by device:

- Desktop: 12.16%

- Mobile: 3.60%

Device placement made a huge difference in the efficiency of our Bing ads. That wasn’t true with our Google ads.

The bottom line

For companies whose target demographic skews older and who searches from a desktop, Microsoft Ads would be a good investment.

Companies that sell B2B SaaS or large capital products are great examples. Those decisions tend to be made higher up the corporate chain. Since the average age of a C-Suite member is 56, and people tend to use PCs over mobile devices to research complex products, that places key decision makers right in Bing’s audience wheelhouse.

It may also be worth testing Microsoft Ads for consumer products aimed at Gen X or boomers. They’re a little more likely to use PCs over mobile than millennials and Gen Z.

Takeaway #4: Microsoft Ads delivers cheaper traffic; Google delivers higher-quality traffic

On average, you’ll be able able to drive more people to your website for less money through Microsoft Ads. But fewer of those visitors are likely to convert once they get there.

Microsoft Ads get better CPCs

Bing beats Google in average cost-per-click (CPC) across all industries.

In fact, Microsoft Ads had cheaper CPCs in every industry. And in B2B, where we work, the average click costs more than double on Google than through Microsoft Ads. We certainly saw the same result from our own ad spend. Our average CPC on Google was $2.30. And on Microsoft Ads? Just $1.69.

Google ads get better CRs

Unfortunately, it’s harder to get those Bing visitors to convert. Globally, Bing’s conversion rates (CR) are about 50% lower than CRs from Google ads.

That’s exactly our experience as well. Our CRs from Microsoft Ads were 50.6% lower than CRs from our Google ads. While we paid less to get people on our site from Bing ads, many of them fell out of our sales funnel after arriving on our site.

The bottom line

You can be successful with Microsoft Ads vs. Google Ads if you meet one of a couple criteria.

Option one, you just want awareness and cheap traffic to your website. For example, you’re launching a new product in a month and want lots of eyeballs reading about it. Or you’re running a political or non-profit campaign, so all you want are mass numbers gaining awareness of your message.

Option two is that you have a strong onsite conversion funnel. The traffic you get from Bing might not be the best quality, but if you can move the percentage of people who would be a good fit for your product efficiently through the buying process, then that cheap traffic would be worth it.

Takeaway #5: Microsoft Ads offers advantages for B2B marketers

The demographic of the average Bing user lends itself to a B2B buying audience. Microsoft Ads makes reaching that audience easier with LinkedIn targeted ads.

We’ve already mentioned that Bing is strong with older searchers and desktop users. And that those characteristics lend themselves to B2B purchases.

Microsoft Ads also happens to have a unique feature among search ad platforms that help marketers capitalize on this particular customer segment. It’s called LinkedIn targeting, and it allows marketers to target customers by their LinkedIn profile information.

Specifically, you can create an ad audience around a company name, industry, or job function. So, if you’re selling an accounting software solution, you could target people who list accounting or accountant in their LinkedIn profile.

You can also see how your ads performed by these LinkedIn criteria, so you know if you’ve targeted the right group.

Google doesn’t have this feature. In fact, Microsoft Ads is the only platform besides LinkedIn that allows you to target an audience by LinkedIn characteristics.

The bottom line

Any B2B marketer would benefit from Microsoft Ads' LinkedIn targeting feature, and most would find Bing’s demographic of users to be a valuable audience. Companies that use account-based marketing, though, would be particularly well-suited to take advantage here.

Account-based marketing is when sales and marketing team up to create a personalized buying experience. It often entails nurturing a relationship with decision makers through social media channels.

With Microsoft Ads, you could hyper-target specific industries and people with titles like “Chief Procurement Officer” or “Director of Technology” and display ads on Bing search results that would be very relevant to those LinkedIn users.

The power of “and” in the question of Google Ads vs. Microsoft Ads

We’ve talked a lot about when you would use Google Ads vs. when you would use Microsoft Ads. The best results come when you use both.

Because when you place branded search ads on Microsoft Ads, you’re not just capturing a piece of their search audience (which they claim is 638 million PC users). You’re also increasing the number of people who search for your brand on Google.

Running cross-network ads on Microsoft Ads actually boosts searches for the same branded terms on Google by 26%.

Increasing searches on a platform that delivers strong conversions--that's a prime plan for PPC success.

Related reading: Google and Bing share many similarities, but their differences in their organic ranking factors should make you take note. Google vs Bing: Optimizing Your Site for Both.