For years, websites have been spending billions of dollars every month on Google Ads. All of those ads create patterns--which are far more helpful when they are built from strong, consistent examples.

We’ve rolled out the biggest PPC data expansion in SpyFu’s history, a 600–1,000x increase in what we’re collecting, sampled hundreds of times per day across every market.

This has been obvious on your charts, and now I want to show you what it means inside the tools that open up deep PPC insights.

A bigger data foundation changes everything

Here's what really matters: A bigger database makes our tools more useful.

Our huge PPC data update directly improves PPC tools across SpyFu like Kombat, Ad History, and PPC Competitors.

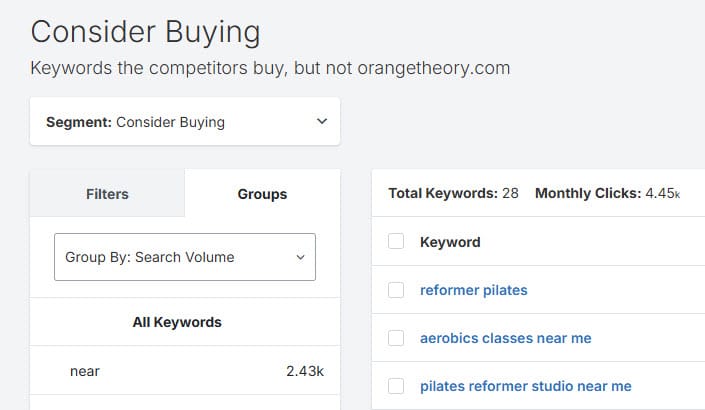

For example, the Kombat tool helps you find keywords that a few of your competitors bid on, but you don't. Now that pool is larger, helping you find more keywords to consider buying that didn't make the list before--because we never saw those ads.

We have filled in holes. We've expanded the sample size to pull from. This update translates to big leaps in accuracy and depth.

We used to sample PPC data once a month. Now we’re sampling hundreds of times per day. That difference sounds technical, but what matters most is that our PPC tools give you greater confidence and deeper insights. You can trust what you're learning, more than ever.

Let's have a look.

PPC Kombat shows real competitive overlap

Kombat has always been about understanding where competitors overlap—and where they don’t. With limited data, those overlaps were directional. Useful, but incomplete.

Now, Kombat is working with a much more complete picture of the market.

Kombat works by comparing up to three domains side-by-side and showing you:

- Keywords all listed competitors are buying

- Keywords that only one competitor is buying

- Keywords your competitors buy — but you don’t

That last gap opens up more opportunities to expand with keywords you've missed. These are competitive enough for at least two of your competitors to both advertise on them. Give them a test to see if you might pick up some quality traffic.

The middle item in the list--keywords where only one competitor is advertising--plays a dual role.

Both roles are even more effective with expanded ad data. If the singled-out competitor is you, look at this list for negative match opportunities. Is there room to trim irrelevant terms that aren't converting?

The answer isn't always yes, though. In fact, when the singled-out competitor is another advertiser, you can review those terms as potential "newly emerging" terms. And new ad data helps you spot these tests earlier than ever.

Filter for competitor-only terms with solid volume and moderate CPC. These are markets they’re actively investing in — and validating for you.

If only one competitor is bidding on non-branded terms — that’s often a growth experiment.

That's one way that SpyFu's deeper ad data helps to make your PPC options clearer.

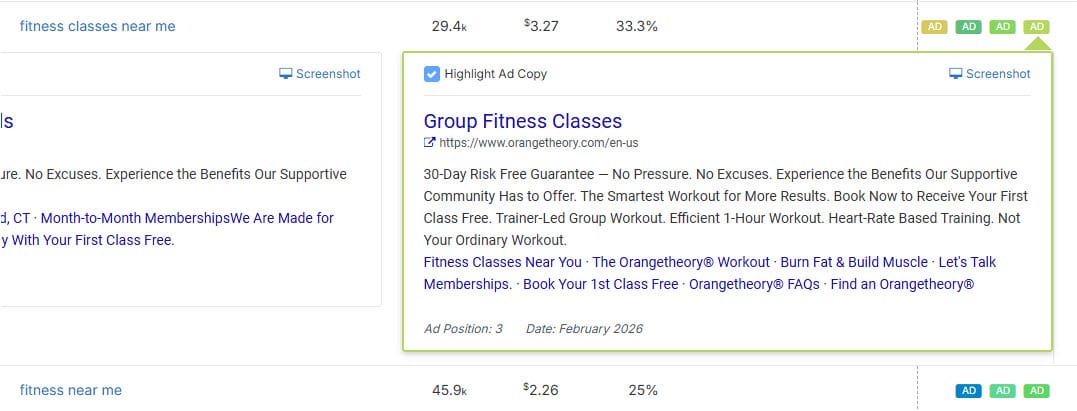

Ad History reveals patterns, not just activity

Ad History gets exponentially more useful as data density increases.

With this upgrade, Ad History is back to doing exactly what it was designed to do--show an advertiser's tests and best ad combinations. This isn’t just showing that an ad existed—it’s showing persistence. You can spot which messages survived months of testing and which disappeared after a short run.

Ad History is best at helping to make a competitor's most dominant messaging stand out. With more ads to work with, that's a stronger signal about what they consider their best foot forward. Hint: these are keywords and ad variations that convert.

The new ad data packs Ad History with a larger pool every month. With 4 months--and growing--of ad patterns, you can be far more confident in how well you're really digging into a competitor's ad practices.

You’re not guessing whether a competitor “might” be investing in a keyword. You’re seeing whether they consistently showed up, how long they stayed, and whether they tweaked the ad copy they used on any of their keywords.

It's like a peek inside their Google Ads planning session.

When you’re looking at billions of dollars in collective ad spend, every long-running ad is a signal. Someone paid to test it. Someone paid to keep it live. Someone decided it worked.

You can now reverse-engineer those decisions with more confidence. Instead of reacting to one-off snapshots, you can study how real advertisers behaved over time—and learn from the mistakes they already paid for.

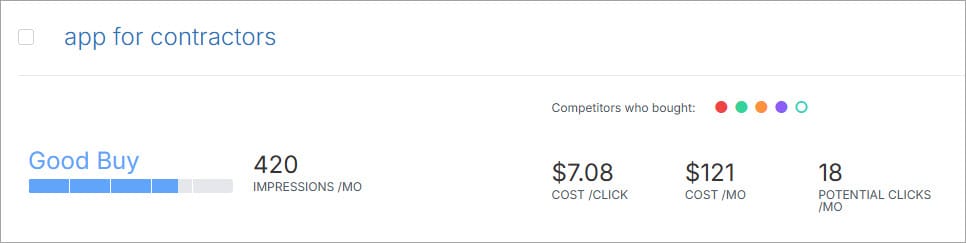

Google Ads Advisor Delivers Stronger, Market-Tested Recommendations

Google Ads Advisor has always been designed to answer a simple question: what should I try next?

With less ad data to pull from, the suggestions were directionally useful, but not as strong as they could be. When you’re working from thinner sampling, you’re making lighter inferences.

Now, Google Ads Advisor can dig into a far deeper set of advertiser behavior across multiple domains. It’s identifying keywords that are consistently being tested, funded, and sustained across the market.

Keyword recommendations--specifically for your Google Ads campaign--come from a dataset that reflects real-world spend, real campaigns, and real persistence.

For customers, this means the recommendations are backed by broader market validation.

If Kombat helps you see where competitors overlap, Google Ads Advisor helps you decide where to move next — with stronger evidence behind every suggestion.

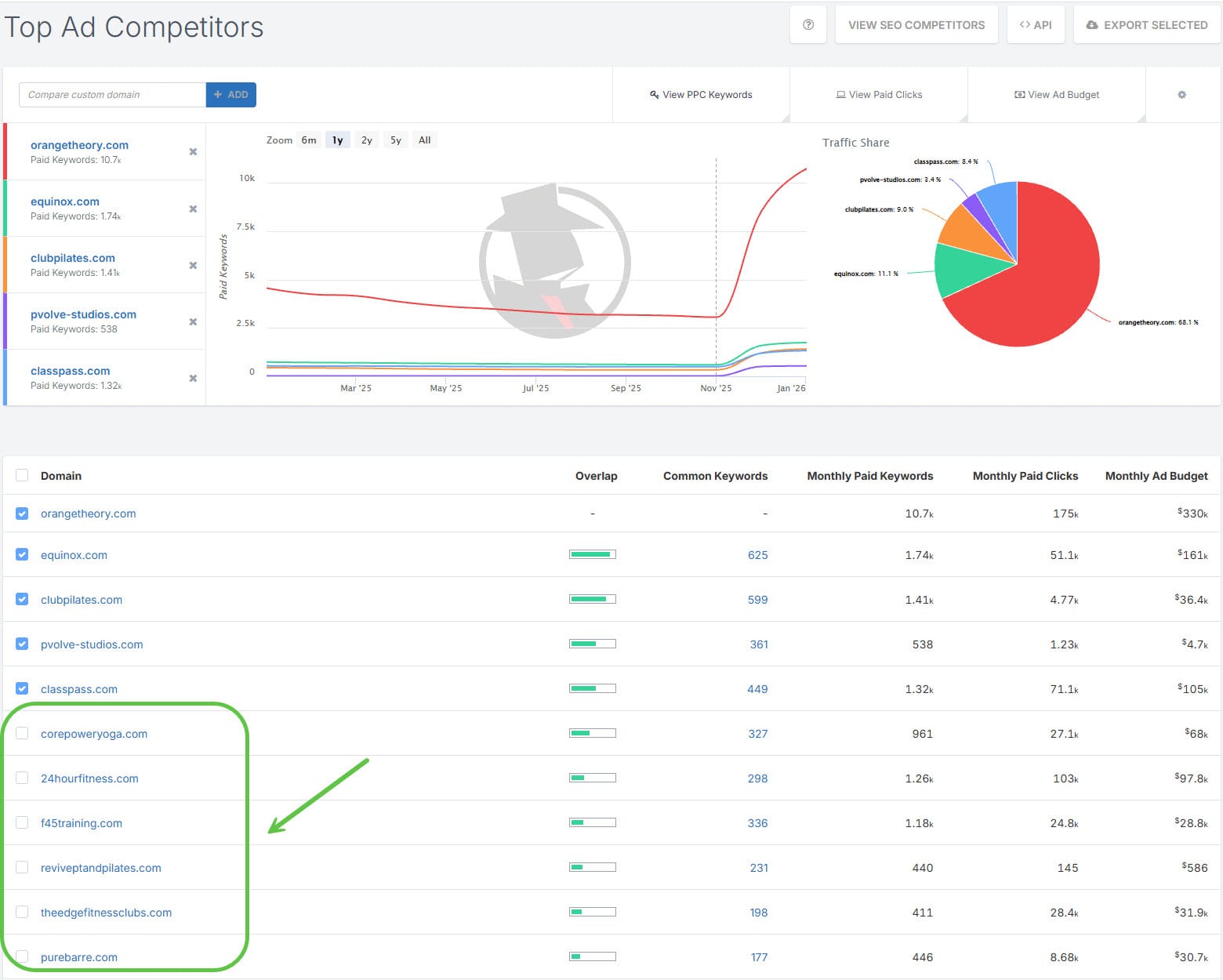

PPC Competitors tool offers more relevance and finds emerging threats

One of the biggest shifts from this data expansion shows up in PPC Competitors.

This tool identifies the top competitors for the domain that you type into the search bar.

Historically, though, local advertisers were the hardest to see. This was mostly because they weren’t running big, steady budgets across multiple regions. Geofencing makes it hard to spot local advertisers if we can't see the ads.

Further, some businesses--local or not--advertise sporadically. Some ramp up during busy seasons. Some test for a week and pull back.

When we were sampling less frequently and on fewer ads, we’d miss a lot of that activity. It just wouldn’t show up.

Now we’re sampling with a wider net, more often.

When you open PPC Competitors, you’re not just seeing the biggest, most consistent advertisers. You’re more likely to see the ones who are actually showing up on SERPs with you — even if they’re smaller or running shorter campaigns.

PPC Competitors tool works by identifying shared paid keywords. This expanded keyword depth helps you feel confident that you're spotting the right competitors--the more relevant ones that are targeting the same terms in Google Ads that you are.

Together, these updates make sure you can spot emerging competitors who could evolve into larger threats. You'll want to keep your eyes on them.

When a competitor appears in your report now, it’s because they’re truly there.

A commitment to PPC depth and insights

This kind of data is hard to collect. It always has been. But PPC data has been the backbone of SpyFu since day one, and it’s on us to keep improving it. We knew the old sampling wasn’t enough, so we rebuilt it. It’s on us to make sure you’re seeing the real market.

When you can see the real Google Ads market—who’s spending, where they’re testing, and what’s actually sticking—you gain leverage.

You can see where competitors ramped budgets and pulled back. You can see which ads quietly ran forever because they worked. You can see entire segments of local advertisers that simply didn’t exist in our view before.

And when the foundation gets stronger, every tool built on top of it benefits.